When budgets tighten and roadmaps shift, hiring stops being a request for headcount and becomes a call for capital allocation. The question isn’t “hourly rate or salary?” It’s whether to carry a fixed cost or keep it variable, whether to buy time-to-value or wait through time-to-fill, and whether this spend should compound into a long-term capability, or simply get a project across the finish line. That’s the real choice at the heart of staff augmentation vs direct hire.

Picture a quarter where one big customer renewal hinges on a new feature, and another where an audit deadline pulls a finance lead into controls for six weeks.

In one lane, the play is staff augmentation: bring in exactly the specialists needed, for exactly as long as needed, under an all-in rate where the provider employs them, runs payroll and benefits, and handles much of the compliance friction. Work gets directed in-house; the employment risk sits outside.

In the other lane, the move is direct hire: put the role on the company’s books, pay salary plus benefits, integrate deeply, and let that capability compound. This is cheaper per unit over time, but with a real upfront and ongoing cost.

Why does this matter now? Because the next two to three quarters are often won or lost on cash efficiency and optionality. The ability to scale up without long approvals and scale down without severance or idle payroll can be the difference between hitting a revenue milestone and missing it.

The benefits of staff augmentation model include speed and a clean exit; direct hire recruitment process facilitates depth and continuity. Both can be the right move. The only real mistake is using one where the other is designed to win.

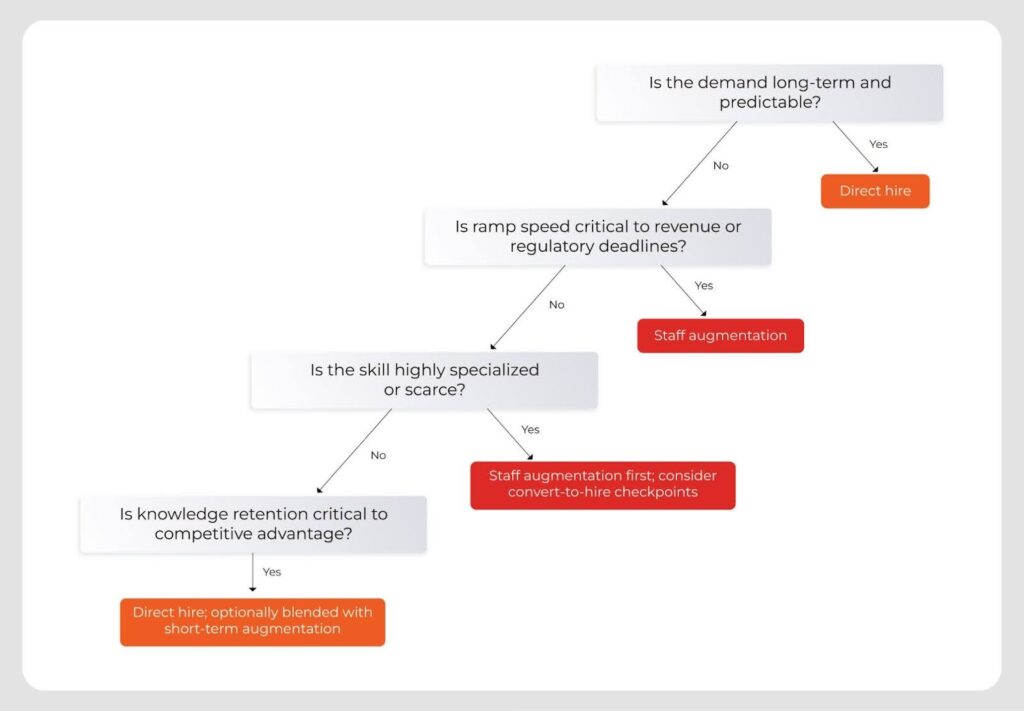

So how do you decide which staffing solution is right for you? Start with three aspects: duration, utilization, and skill scarcity. If demand is variable, time-boxed, or highly niche, augmentation converts spend into outcomes fast, and the cost ends when the work is done.

If a role will run at high utilization for 18–24 months or more, direct hire typically wins on total cost of ownership and knowledge retention. Compliance requirements and knowledge criticality nudge the choice at the margins, but the center of gravity is still duration and utilization.

In other words, when the mission is sprint, rent the speed. When the mission is compounding, own the engine.

Staff augmentation vs direct hire: Cost components that move the needle

When assessing staffing cost efficiency, focus should not be on the headline rate, but rather on the cash that actually leaves the business and the costs that quietly compound over time.

Where do dollars go before day one? How long until productivity shows up? What’s baked into payroll beyond base pay? Which costs stop when the project stops, and which linger on the balance sheet?

Below are some costs to look at:

Upfront hiring costs

- Direct hire: internal recruiter time, media, assessments, interview panels, plus potential agency fees (commonly 18–25% of first-year salary for experienced roles). A $150k base translates to roughly $27k–$37.5k before day one.

- Staff augmentation: sourcing and screening are embedded in the vendor’s rate; minimal internal cycle time. The “premium” is visible in the hourly bill rate rather than cash outlay up front.

Training and onboarding

- Direct hire: ramp time and manager bandwidth are borne in-house; productivity is often measured in months for complex roles.

- Staff augmentation: role-ready specialists shorten ramp; readiness is priced into the rate and spread across the contract term.

Payroll and benefits

- Direct hire: salary plus roughly 20–30% for benefits, payroll taxes, insurance, retirement, and potential severance.

- Staff augmentation: a single all-in rate replaces benefits and taxes on the client side; idle-time risk shifts to the vendor.

Overhead and tools

- Direct hire: devices, software seats, facilities, and ongoing people ops support.

- Staff augmentation: many providers shoulder portions of infrastructure; client-provisioned tools align to the project window only.

Flexibility and scalability

- Direct hire: harder to flex down; underutilization becomes sunk cost and reductions invite severance and morale risk.

- Staff augmentation: scale up or taper to match burn-down; cost stops when the project stops.

| Cost factor | Staff augmentation | Direct hire |

| Upfront hiring costs | Vendor rate includes sourcing and screening; minimal internal spend. | Agency fees can reach 18–25% of first-year salary, plus internal recruiter time and interview costs. |

| Time-to-productivity | Days to weeks via vetted, role-ready talent. | Often months for full onboarding and ramp. |

| Payroll and benefits | No client-side benefits or employer taxes; covered in the all-in rate. | Salary plus roughly 20–30% for benefits, payroll taxes, insurance, retirement, and potential severance. |

| Utilization risk | Ends with the project; no bench cost. | Payroll lingers during demand dips. |

| Overhead | Often lighter or vendor-carried. | Devices, software, facilities, and people ops borne by employer. |

| Long-run cost | Higher hourly rate; efficient for ≤18–24 months with variable demand. | Cheaper beyond ~24 months with steady utilization. |

| Compliance risk | Vendor as employer of record mitigates exposure. | Full employer liability and potential severance risk. |

Strategic considerations for CFOs

Choosing between direct hire staffing and staff augmentation solutions is less about preference and more about matching capital to certainty. The temp-to- perm hiring strategy is advantageous when done right but you need to make certain assessments. Start by considering how long the work will last, how fully the seat will be utilized, and how scarce the skills are. Then ask the operating question: where does flexibility protect downside without starving upside, and when does permanence compound value faster than any premium saved?

Project length

- For ≤18 months or spiky demand, staff augmentation cost benefits typically outweigh the rate premium because spend tracks delivery and stops at project end.

- Beyond ~24 months, the premium compounds, utilization is defensible, and direct hire cost analysis usually wins on run-rate and ownership of capability.

Skill scarcity

- Niche skills (cloud security, pharmacovigilance data ops, advanced analytics) inflate recruiting fees and time-to-fill, raising the cost of a miss.

- Augmentation compresses time-to-value with vetted specialists and de-risks delays; convert to hire later if the need proves durable.

Business volatility

- When revenue or roadmap is uncertain, default to variable cost and keep options open.

- Treat talent as an operating expense until signal stabilizes; commit to payroll only once utilization is proven.

Knowledge retention

- If the function is a core advantage, direct hire preserves institutional memory, process equity, and cross-functional glue.

- Pair with short-term augmentation for peak load, but keep the center of gravity in-house.

Compliance and jurisdictions

- Complex payroll, clearances, or multi-geo work often benefits from providers with established compliance operations and employer-of-record coverage.

- Direct hire concentrates obligations internally; ensure legal, tax, and HR infrastructure can carry the load before locking in.

Case example: the 9‑month runway

Think of a mid-market SaaS renewal that depends on a new security feature shipping in two quarters. Cash is tight. The post‑launch backlog is unclear. The CFO needs two senior cloud security engineers and a QA automation lead for about 6–9 months. That’s the brief and the risk.

Option A is direct hire staffing. It builds capability, but the meter starts early. Agency fees to land three experienced hires can run near $100k before day one. Add roughly 25% in benefits and payroll burden on top of salaries, plus ramp and tooling. If demand eases after launch, payroll keeps ticking or severance hits cash. The upside is stability; the downside is commitment.

Option B is staff augmentation. The all‑in rate for the trio (about $180–$220 an hour) looks higher on paper, but the cash flow is different. There’s no recruiting outlay, no benefits drag, faster ramp, and a clean exit when the feature ships. Spend maps directly to the project timeline and stops when the work stops. The upside is speed and optionality; the downside is a higher visible hourly.

The call is straightforward. For a time‑boxed release with uncertain afterlife, augmentation protects working capital and buys time-to-value. If the roadmap firms up and utilization becomes predictable, convert one role later on a clear business case. That way, the team keeps the knowledge that matters, and the payroll only grows when it should.

Also read: Why Contract-to-Hire Staffing Could Be Your Best Hiring Move This Year(Or Not)

To Conclude

Think of talent like capacity planning: keep workloads elastic while risk is high, and lock them in only when the pipeline is steady and the know‑how is worth anchoring.

- Blend smart: utilize staff augmentation services to absorb spikes and niche work; transition enduring, full-time lanes to direct hire when they remain consistently filled quarter after quarter.

- Plan conversion: set 90–180 day convert‑to‑hire checkpoints so proven contributors can transition without losing momentum or knowledge.

- Pay for outcomes: tie augmentation spend to milestones, such as release shipped, audit closed, and integration live, so ROI is visible.

- Keep the playbook: require documentation, structured handoffs, and shadowing before roll‑off.

- Protect TCO: track utilization and redeploy direct hires fast if load drops.

See what the right mix looks like with SPECTRAFORCE. Get a quick, CFO‑ready comparison, modeled to roles, duration, and utilization, with transparent rates, time‑to‑submit, and conversion options.

Our team will map scenarios and provide a clear cost view before any spend is committed, so you can choose a model that suits your vision and needs